Sign-up is all online and you can start screening tenants within minutes.

Find great tenants on the spot.

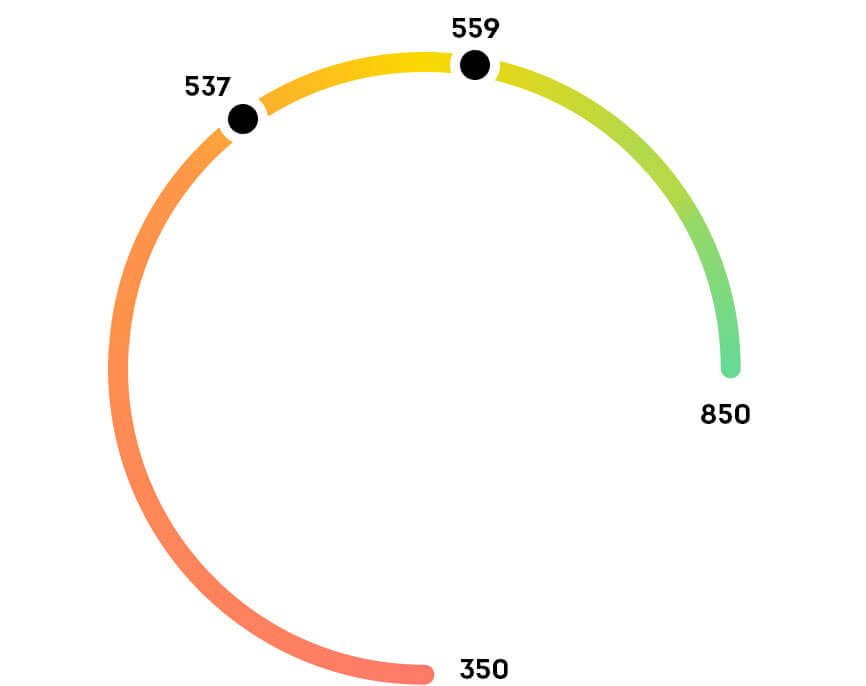

Prospective tenants are awarded a rating from 350-850, with 850 being the best possible score. The score is generally made up 5 factors (actual score elements may vary based on specific tenants being scored):

Choose who pays and no hidden fees.

When an average eviction cost $3,500✝, be more confident with our most complete screening package.

When you want a little more information on your potential tenant.

Our basic screening includes our proprietary score and criminal background check.

Our basic screening includes our proprietary score and criminal background check.

**The Criminal Report and Eviction Related Proceedings Report are subject to federal, state, and local laws that may limit or restrict SmartMove's ability to return some records. Certain jurisdictions may limit what records are eligible for return, click here for more information.

Built specifically to identify the likelihood of eviction better than a typical credit score.

Get more insights on people who have thin files that would otherwise not be able to get a score (can score all applicants with at least one account on their credit report).

ResidentScore that specifically analyzes predictors of a bad rental outcome better than a typical credit score.

ResidentScore assigns a score from 350-850, with 850 being the best score possible. This score is designed to take credit report data into account when determining a tenant's score.

Both a typical credit score and SmartMove® ResidentScore can help minimize risks when screening an applicant. However, ResidentScore is explicitly engineered for rental screening and is designed to provide a better estimation of risk to your future rental property income than a typical credit score*. Below are the benefits of ResidentScore over a standard credit score:

With ResidentScore, you aren’t stuck basing your decisions on the same algorithms that a bank would use. Instead, you’re using a score that specifically analyzes predictors of a bad rental outcome.

Information for Good.®

Connect with us

© Copyright 2024 TransUnion LLC. All Rights Reserved.

As you use this website, we and our third-party providers collect your internet and other electronic network activity information (IP address, device information, and information regarding your interaction with this website) via cookies and other technologies. We use this personal information to enhance user experience, analyze performance and traffic on our website, and to provide targeted advertising. If you would like to opt out from the use of non-essential third-party cookies, please select the “Restrict All” option. To learn more about how we use cookies, see our Privacy Notice.

Please note that:

Your cookie settings have been applied.